财政部海关总署税务总局关于海南自由贸易港原辅料“零关税”政策的通知

Notice on Hainan Free Trade Port’s Zero-Tariff Policy for Raw and Auxiliary Materials Issued by

Ministry of Finance, General Administration of Customs and State Taxation Administration

海南省财政厅、海口海关、国家税务总局海南省税务局:

Hainan Provincial Department of Finance, Haikou Customs, Hainan Provincial Taxation Bureau of State Taxation Administration:

为贯彻落实《海南自由贸易港建设总体方案》,经国务院同意,现将海南自由贸易港原辅料“零关税”政策通知如下:

To implement the ‘Overall Plan for the Construction of Hainan Free Trade Port’, with the approval of the State Council, the Hainan Free Trade Port’s zero-tariff policy for raw and auxiliary materials is hereby notified as follows:

一、在全岛封关运作前,对在海南自由贸易港注册登记并具有独立法人资格的企业,进口用于生产自用、以“两头在外”模式进行生产加工活动或以“两头在外”模式进行服务贸易过程中所消耗的原辅料,免征进口关税、进口环节增值税和消费税。

1. Before the operation of the island-wide customs clearance, for enterprises registered in Hainan Free Trade Port as independent legal entities, the imported raw and auxiliary materials consumed for own production, for import-process-export production activities, or for import-service-export in the process of trade in service, are exempt from import duties, import value-added taxes and consumption taxes.

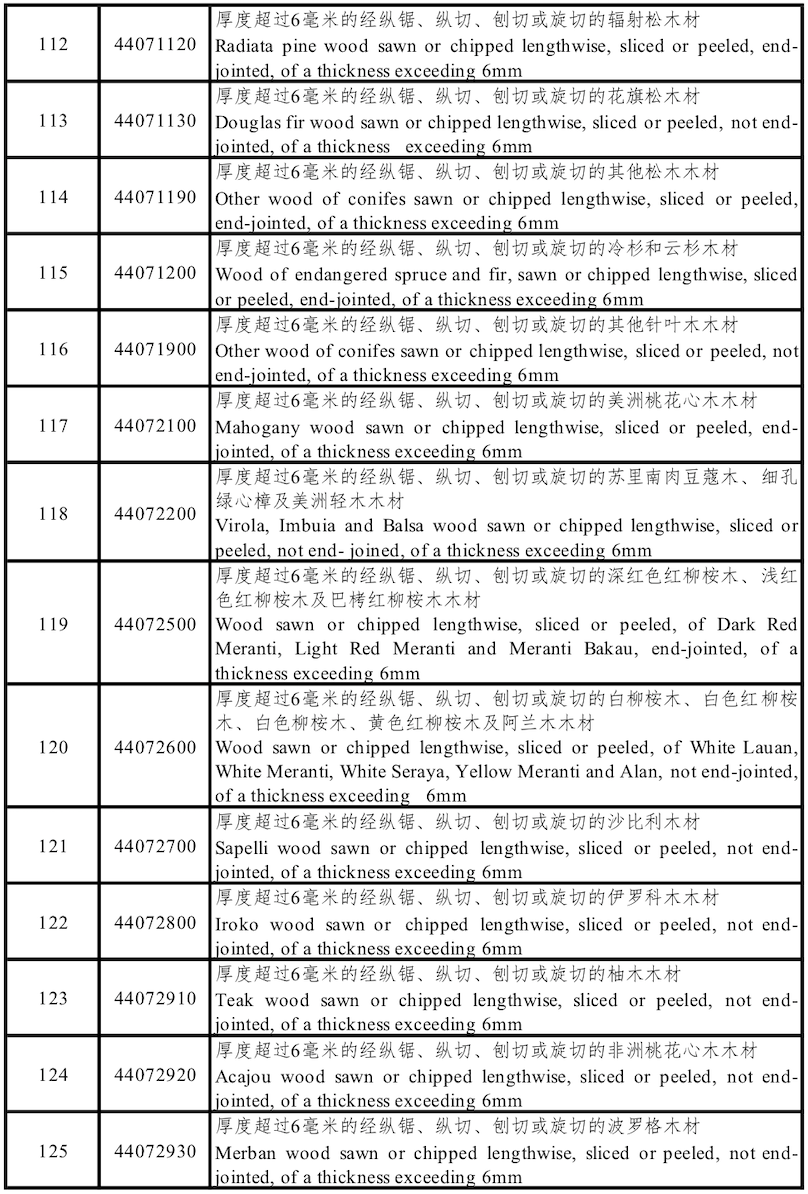

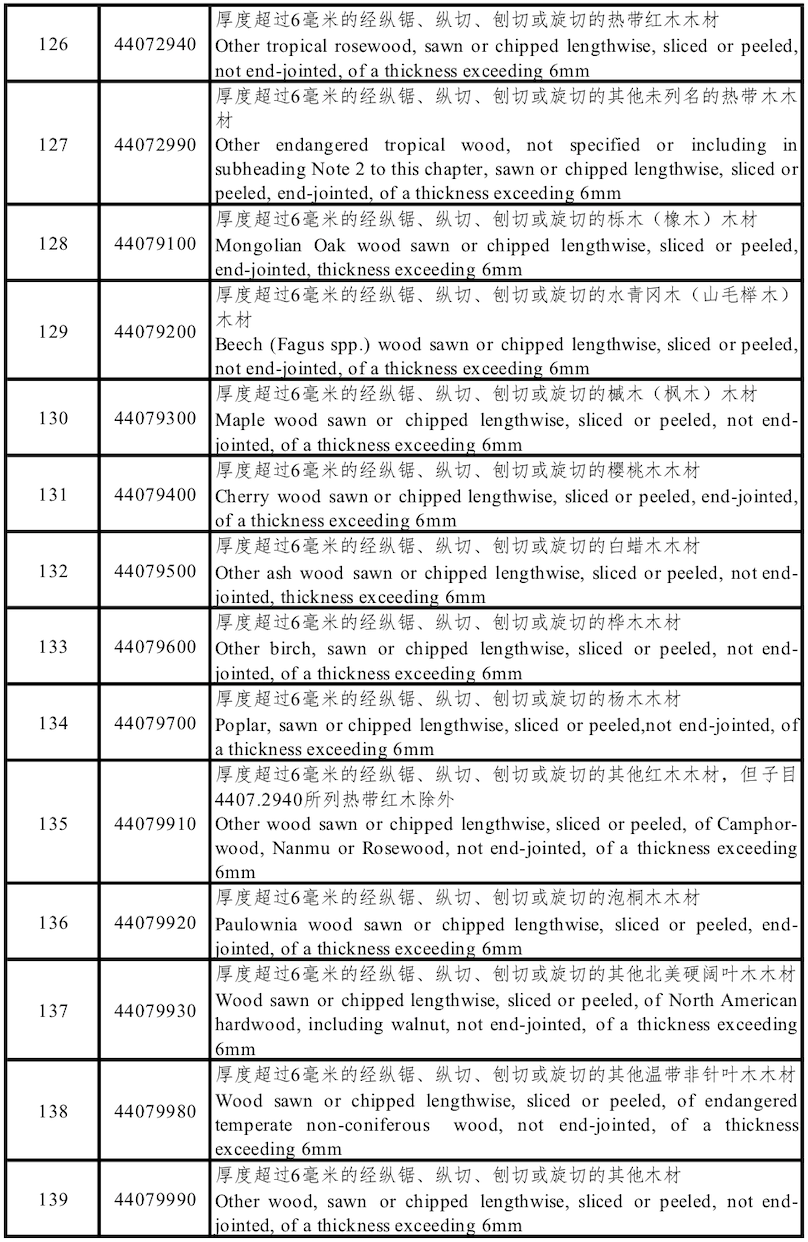

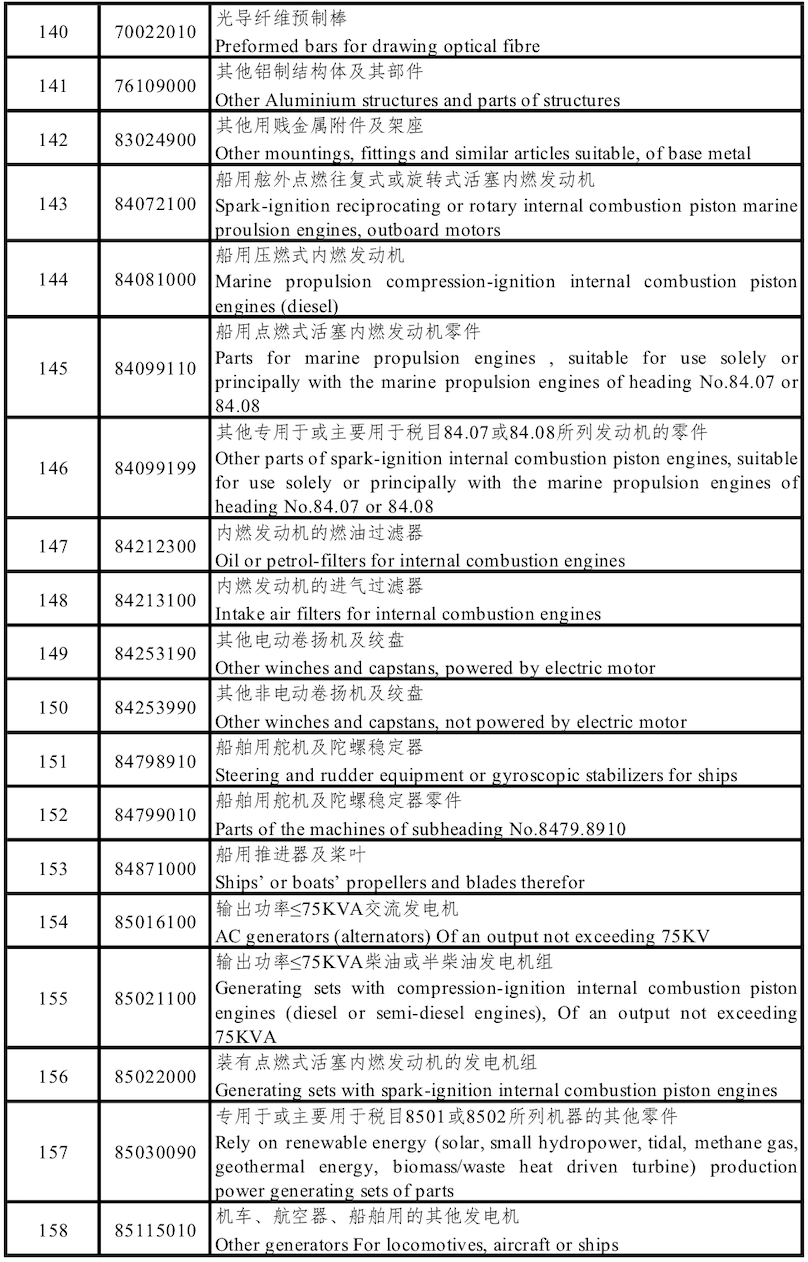

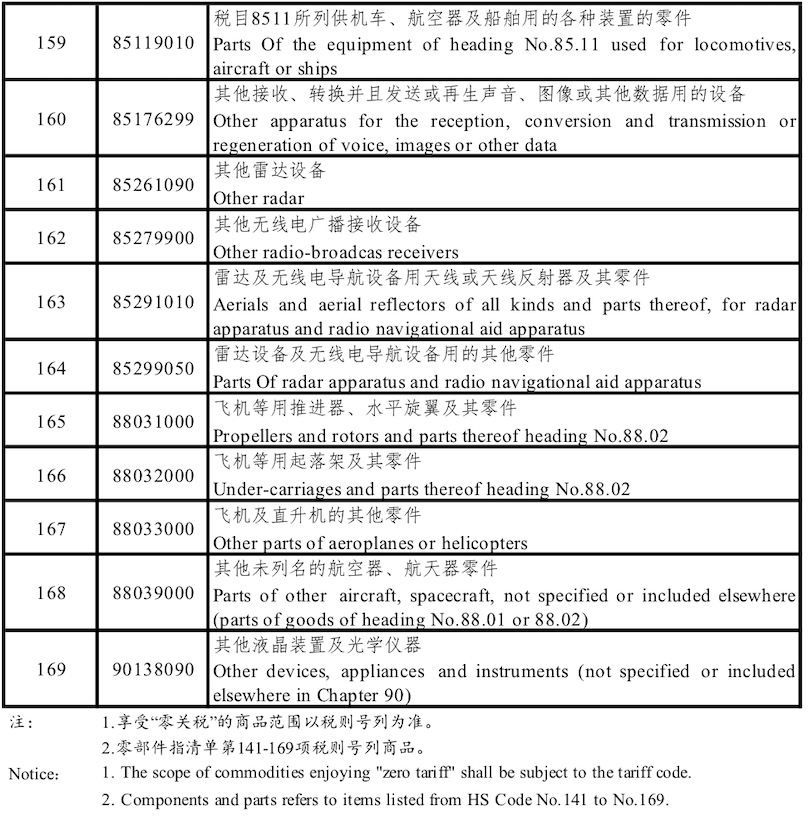

二、“零关税”原辅料实行正面清单管理,具体范围见附件。清单内容由财政部会同有关部门根据海南实际需要和监管条件进行动态调整。

2. Zero-tariff raw and auxiliary materials are subject to positive list management, and the specific scope is shown in the appendix. The contents of the list are dynamically adjusted by the Ministry of Finance and relevant departments in accordance with the actual needs and regulatory conditions of Hainan.

三、附件所列零部件,适用原辅料“零关税”政策,应当用于航空器、船舶的维修(含相关零部件维修),满足下列条件之一的,免征进口关税、进口环节增值税和消费税:

3. Parts and components listed in the appendix are subject to the zero-tariff policy for raw and auxiliary materials and should be used for maintenance of aircraft and ship (including maintenance of related parts and components). Should any one of the following conditions be met, import tariffs, import value-added taxes and consumption taxes could be exempted:

(一)用于维修从境外进入境内并复运出境的航空器、船舶(含相关零部件);

(1) Items used to repair aircraft and ships (parts and components included) that enter the border and would be re-transported out of the country;

(二)用于维修以海南为主营运基地的航空企业所运营的航空器(含相关零部件);

(2) Items for the maintenance of aircraft (parts and components included) operated by aviation companies whose main operating base is in Hainan;

(三)用于维修在海南注册登记具有独立法人资格的船运公司所运营的以海南省内港口为船籍港的船舶(含相关零部件)。

(3) Items used to repair ships (parts and components included) operated by shipping companies registered in Hainan as independent legal entities and whose port of registry are ports in Hainan Province.

四、“零关税”原辅料仅限海南自由贸易港内企业生产使用,接受海关监管,不得在岛内转让或出岛。因企业破产等原因,确需转让或出岛的,应经批准及办理补缴税款等手续。以“零关税”原辅料加工制造的货物,在岛内销售或销往内地的,需补缴其对应原辅料的进口关税、进口环节增值税和消费税,照章征收国内环节增值税、消费税。“零关税”原辅料加工制造的货物出口,按现行出口货物有关税收政策执行。

4. Zero-tariff raw and auxiliary materials are restricted to production and use by enterprises in the Hainan Free Trade Port, subject to customs supervision, and are prohibited to be transferred within or leave the island. In case of real necessity for the materials to be transferred or leave the island due to bankruptcy and other reasons, approval must be obtained taxes should be paid. For goods processed and manufactured with zero-tariff raw and auxiliary materials to be sold on the island or in the mainland, import tariff, import value-added tax and consumption tax of the corresponding materials must be paid, and domestic value-added tax and consumption tax shall be collected according to regulations. The export of goods processed and manufactured with zero-tariff raw and auxiliary materials shall be implemented in accordance with current tax policies for export goods.

五、企业进口正面清单所列原辅料,自愿缴纳进口环节增值税和消费税的,可在报关时提出申请。

5. Enterprises importing raw materials listed in the positive list and voluntarily paying import value-added tax and consumption tax can apply at customs declaration.

六、相关部门应通过信息化等手段加强监管,防控可能的风险、及时查处违规行为,确保原辅料“零关税”政策平稳运行。海南省相关部门应加强信息互联互通,共享航空器、船舶等监管信息。

6. Relevant departments should strengthen supervision through information-based and other means, prevent and control possible risks, promptly investigate and deal with violations, and ensure the smooth operation of the zero-tariff policy for raw and auxiliary materials. Relevant departments of Hainan Province should strengthen information inter-connectivity and share regulatory information on aircraft and ships.

七、本通知自2020年12月1日起执行。

7. This notice will be implemented from December 1, 2020.

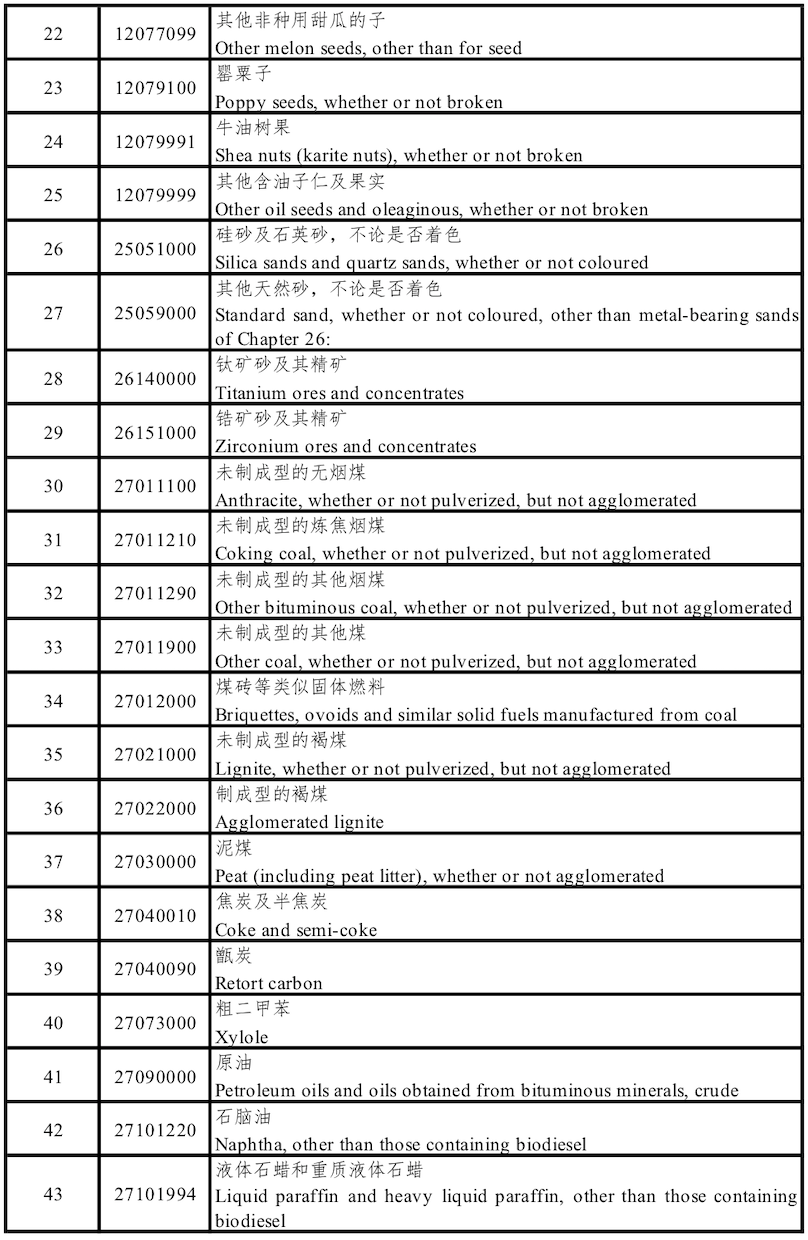

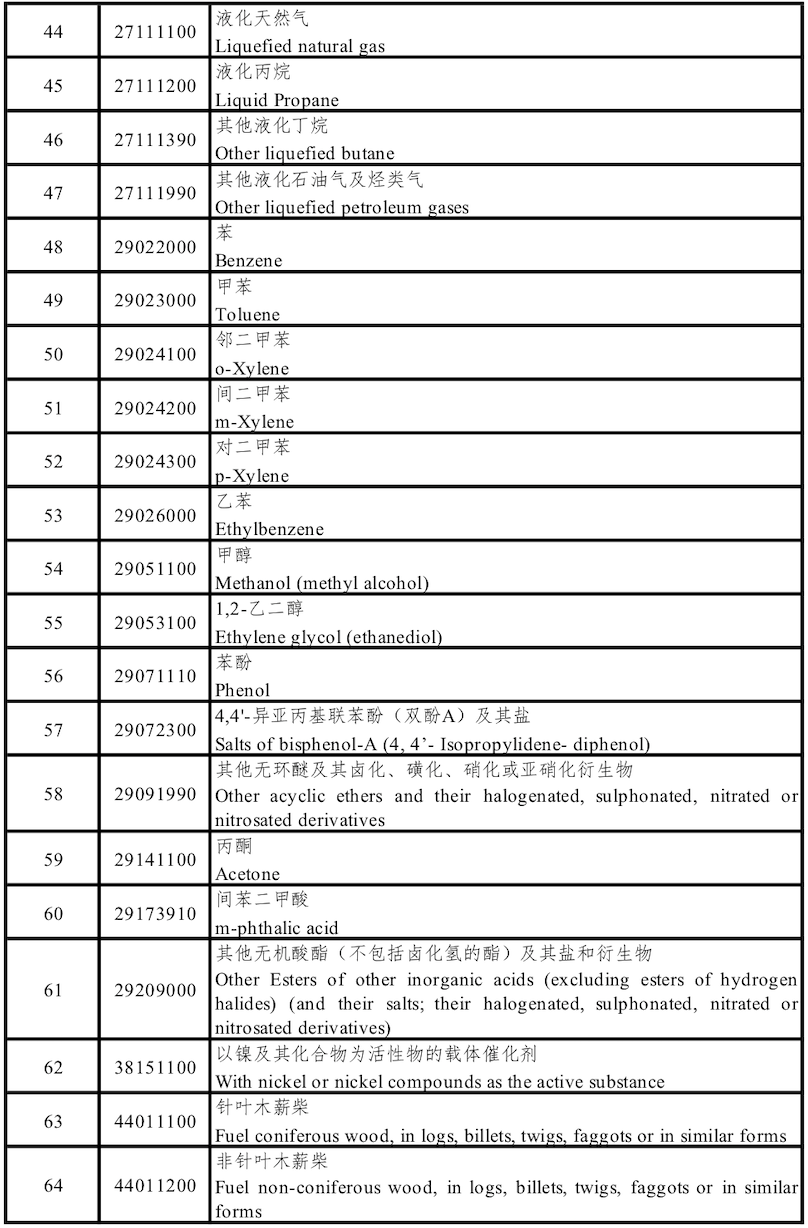

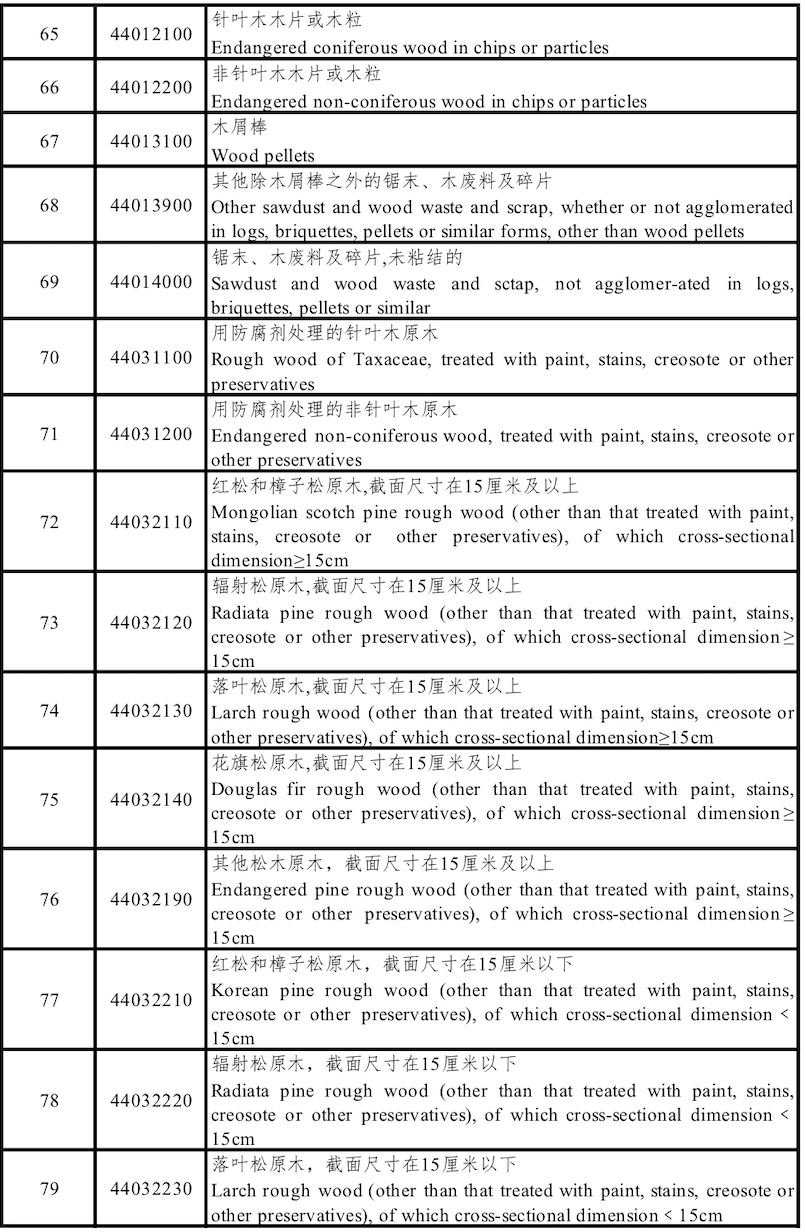

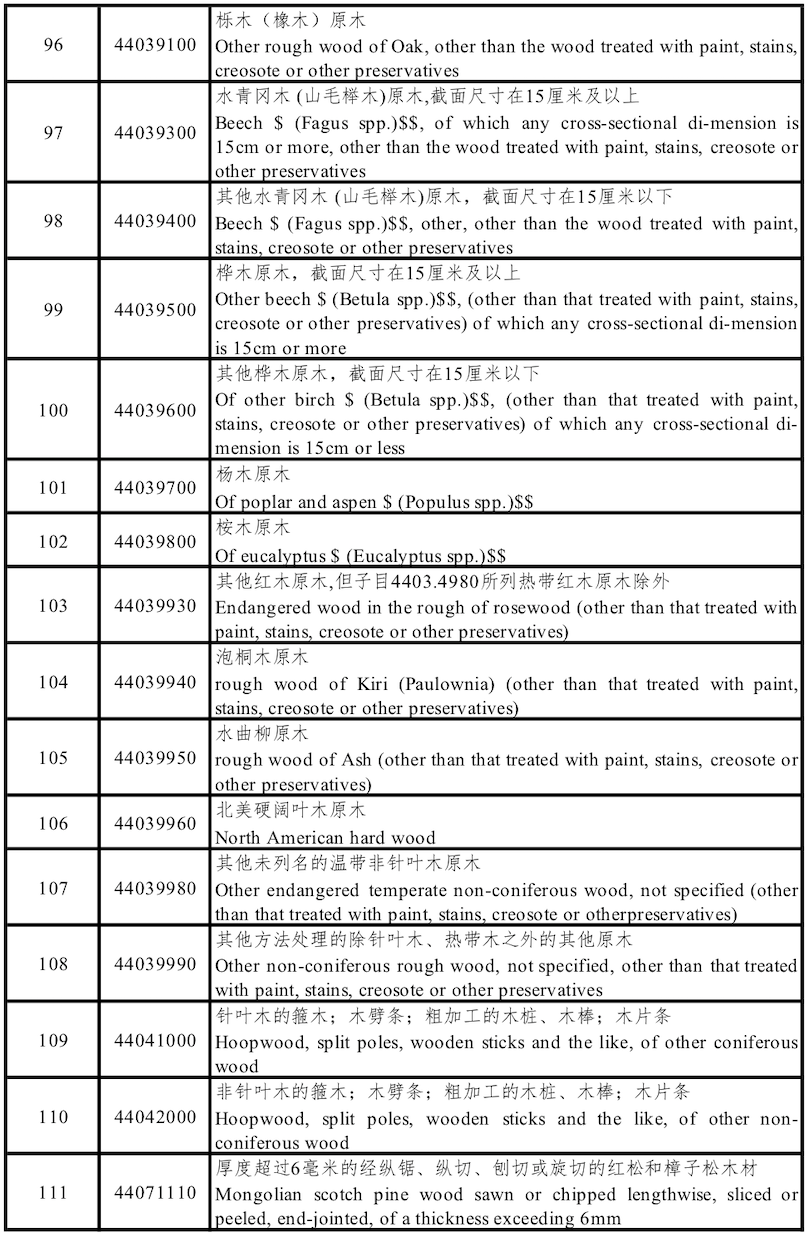

附件:海南自由贸易港“零关税”原辅料清单

Appendix: Hainan Free Trade Port List of Zero-Tariff Raw and Auxiliary Materials

财政部海关总署税务总局

Ministry of Finance

General Administration of Customs

State Taxation Administration

2020年11月11日

November 11, 2020

附件

Appendix

海南自由贸易港“零关税”原辅料清单

Hainan Free Trade Port List of Zero-Tariff Raw and Auxiliary Materials

琼公网安备 46010802000409号

政府网站标识码:4600000057

琼ICP备18002373号-4

琼公网安备 46010802000409号

政府网站标识码:4600000057

琼ICP备18002373号-4

您访问的链接即将离开“海南省商务厅”门户网站

是否继续?